Seeing the Forest Through the Trees: Short-Term Volatility and Long-Term Returns

By mid-September, we’d received some comments from clients about perceived losses in their accounts. One client wrote: “The last couple of months I have had pretty substantial losses in my investments but know that we're in it for the long haul.”

I was happy to read that the client recognized the long-term nature of their investment portfolio, but I was troubled by the “substantial losses” the client perceived. So I checked the client’s returns and saw that rather than substantial losses, the client had actually experienced modest gains in the preceding month and pretty good returns in the preceding 3 months, the year-to-date, and the last 12 months. Something wasn’t clicking.

As we communicated with clients about their concerns, a common theme began to emerge: clients explained that they had seen decreases in the value of their portfolios in 2 of the last 3 months, and in doing so figured that things had gotten pretty bad.

This was great news. Not the 2 down months; no one likes to see portfolio values go down. Instead, it was the inference of substantial losses based on those 2 months, because that presented a chance to talk about long-term returns vs. short-term volatility (or in English, seeing the forest through the trees).

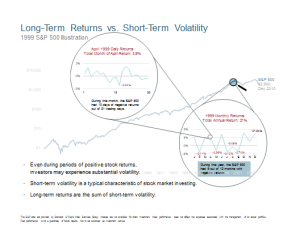

Dimensional Fund Advisors put together a neat graphic to illustrate this concept. (Click on the picture to enlarge.)

The text might be a little small to read, but the message is straightforward. In 1999, the S&P 500 Index (a barometer for large US company stocks) returned a little over 21% for the year. But in that year, the index had negative returns in 5 out of the 12 months. In April, 1999 alone, the S&P 500 Index experienced negative returns on just under half of the available trading days, yet it still managed to return 3.9% for the entire month. The short-term volatility was the “price” investors had to pay to experience longer term returns.

The same concept was in play in 2013. Some folks were paying heavy attention to the decreases in value they saw in June and August. But in doing so, they weren’t factoring in the positive month of July, where gains mostly outpaced the combined drops of the two down months. Moreover, the fact that the two negative months happened so recently obscured from view the fact that the first 6 months of the year had been overwhelmingly positive.

The world and the stock market are pretty volatile places, and the volatility of each is magnified by the 24-hour news cycle and seemingly never-ending analysis, over analysis, yammering and screaming. Most of what we see, read and hear is focused on the trees. At Woodward Financial Advisors, we think it’s much more important to pay attention to the entire forest.