Presidential Election Have You Worried About Your Portfolio?

Photo credit: Aquir / Shutterstock.com

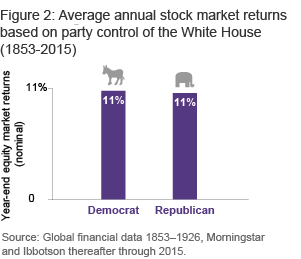

Well, we have some good news: the stock market is nonpartisan! Based on research done by Vanguard dating all the way back to 1853, market returns have been nearly identical no matter which political party was in control of the oval office.

Is it possible that market volatility will increase as we approach the November election and continue for some time after the new President has been selected? Absolutely. And it’s easy to get caught up in the emotion of a Presidential election, either because one has fervent views on a particular candidate’s policies or simply due to a strong party allegiance. At Woodward Financial Advisors, our role is to take the emotion out of the equation, acting as the “surge protector” between client emotion and potentially harmful portfolio actions.

We’re all human and we understand the desire to want to do “something” during times of uncertainty, but what does the research show we should do? Long-term research shows that focusing on things that you can control such as being diversified, keeping costs low, rebalancing, and minimizing taxes will lead to better long-term results than chasing the fool’s gold of market timing.

Part of the trade-off of being a long-term stock market investor is that over time, we’re compensated for withstanding the added short-term volatility that equity markets sometimes produce.

Here’s our political promise - we’ll remain steadfast in helping you on the path toward achieving your long-term financial and life goals, no matter if a donkey or an elephant is moving into 1600 Pennsylvania Avenue come January 2017.

WFA approves this message!