What Can Hurricane Joaquin Teach Us About Retirement Planning?

You’ve undoubtedly been hit over the head by Hurricane Joaquin coverage the last couple days, with more reporting sure to come over the next week. If you weren’t familiar with the “cone of uncertainty” before, you most assuredly will be by the end of this hurricane season. In simple terms, the cone of uncertainty refers to the possible path a hurricane may take, based on scientific technology at this early date in the process. The cone is narrow in the beginning because we are more certain about the next hour or day, but then the cone widens as time goes by because there are more possibilities as we get beyond the next day or two.

Take a look at the forecast models for Hurricane Joaquin from yesterday. The beginning lines are tightly layered on top of each other while as time goes on the possible paths diverge significantly. It looks like this storm could end anywhere from Ohio to Bermuda! However, it will most likely follow a path to the mid-Atlantic and northeast states, where you can see the majority of the lines converge.

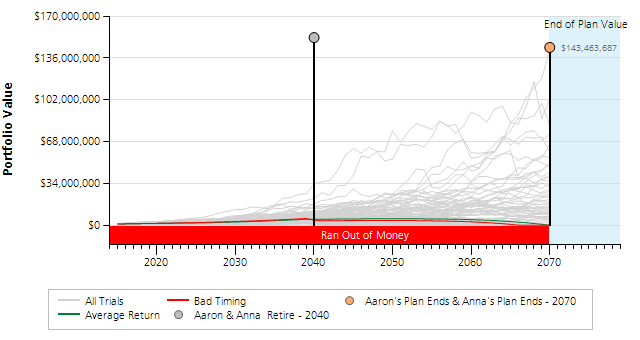

In financial planning, we have our own “cone of uncertainty,” and it relates to Financial Independence. We run retirement projections for clients based on known current information, but the projections run through their life expectancy which can be many decades. Our level of certainty for how things will look a year or so in the future regarding finances is pretty high, while how things will look ten or twenty years from now is much less known. Here is a projection chart for sample clients that are 40 years old, 25 years from retiring and about 55 years from dying. Each strand represents a possible outcome in our analysis with regard to their portfolio value. You can see there is a 1 in 10,000 “possibility” that they could end up with $143,000,000 at the end of their life expectancy. That won’t happen, but it could! There is also a 1 in 10,000 possibility they will run out of money right after they retire. That won’t likely happen either! The majority of the strands congregate in one area that represents the most likely portfolio value: $3,000,000 or so.

While one could worry that these possible outcomes are wildly different, our job is to focus the conversation on the more likely results. We do that based on the information we know today, discussing the end result with the greatest likelihood of occurring and frequent updating of the plan so that course corrections can be made if needed. As time goes by, the level of certainty - from both financial planners at Woodward Financial Advisors and meteorologists at The Weather Channel - increases.