Trust the Process

Over the last 4 years, the NBA’s Philadelphia 76ers have consistently lost in historic fashion. Strange as it might sound, this was intentional: the worst team each year has the highest odds of winning an early pick in the next year’s draft, which is usually where the better players can be found. Philadelphia’s management believed that this was their best path to getting better. And by some metrics, the plan worked. Those four years of epic and calculated losing resulted in lots of high draft picks, and Philadelphia is now formidable. Along the way – despite much ridicule and public pressure – the 76ers clung to a simple mantra: Trust the Process.

We’re not building a basketball team at Woodward Financial Advisors (yet), and we certainly don’t advocate losing on purpose. But we wholeheartedly subscribe to the importance of processes. While the 76ers have been busy losing, we’ve been building, tweaking and formalizing the processes and workflows that make our firm run.

There’s a tendency to avoid talking about what goes on behind the scenes at advisory firms, with the belief that folks don’t want to “see how the sausage is made.” That’s understandable in some circumstances. But if I was on the outside looking in, I would draw tremendous comfort from learning that an organization that I trusted to manage my life’s savings went to great lengths to formalize and institutionalize all the tasks that go into accomplishing that.

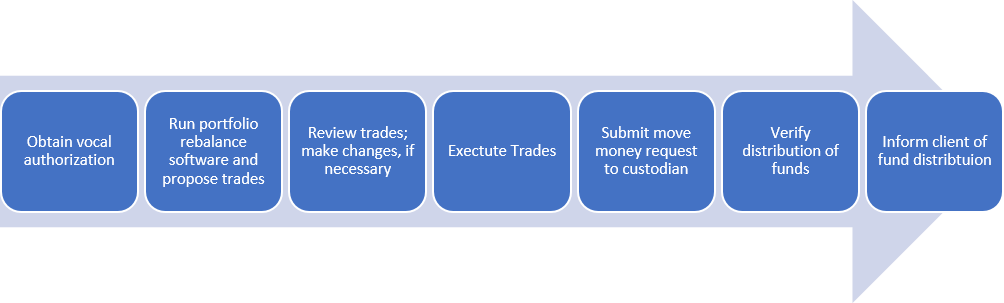

Our business processes range from the mundane (e.g., changing a client’s address) to the series of steps and tasks that go into preparing for and holding a client meeting. One of the more frequently used processes is for when clients call to request cash from their portfolios, a simplified version of which is laid out below:

Each box represents a separate task in this process. As each task is completed, the subsequent task is triggered and shows up on the next person’s to-do list. Some steps are only kicked off if certain criteria are met. For example, if a client account has enough cash such that any scheduled distributions won’t be compromised by the request, we might not suggest or make any trades. In other business processes, some tasks consist of instructions to refer to a separate checklist that contains items to review, like with our annual Tax Return Review.

So far, we’ve got 55 active business processes, and we’re constantly tinkering. We have a standing Process Committee whose job it is to solicit feedback, develop new processes and refine existing ones.

Why do we spend so much time thinking about and improving our processes?

- Consistency – we want to make sure that all clients enjoy the same client experience. Processes ensure that we all do things the same way for each client.

- Accountability - each step in a business process is assigned to someone. That way, we can see where we are in each process, as well as where any bottlenecks might be.

- Risk Management – if only one person knows how to do perform some action and that person goes on vacation or gets hit by a bus, we’re in trouble. By documenting our processes, we make ourselves a lot less vulnerable to losing institutional knowledge.

- Training – it’s a lot easier to bring a new WFA team member up to speed on how we do things if everything is documented.

We can’t control every outcome. But we can certainly control the steps in the process. In future blog posts, we’ll talk about how this idea is infused into many of the planning and investment-related things we do.

We know that our process-oriented culture results in long-term success for our clients. If you think we might be able to help you, let us know.